Meeting with an insurance sales representative virtually or in person is often the most efficient way to make sure you obtain the coverage you need at rates you can afford. Whether you’re shopping for insurance for the first time or looking to renew your coverage, there are a few questions you should consider before meeting with your insurance agent.

How much life insurance coverage do I need?

This is one of the most important questions to ask your agent.

Life insurance

coverage amounts are based on two major factors: your outstanding debts, including your mortgage, and how much money your dependents will need to maintain the same lifestyle after you’ve passed. In addition to these main factors, insurance carriers often use different formulas for determining your specific insurance needs.

How much will this policy cost?

The cost of your life insurance policy will depend on a variety of factors from the insurance carrier. Your Symmetry agent will need to know your age, gender, lifestyle, the type of life insurance you need and your medical status, which may involve a required physical from a medical doctor.

Knowing these factors will help the life insurance company assess your risk level. The higher your risk level, the higher your life insurance premium will be.

Additional factors that will determine your rate are:

-

The coverage amount

-

Other life insurance policies you already own

-

Your health

-

Your weight

-

Tobacco use

-

Other risk factors (DUI, potentially dangerous hobbies, etc.)

Can I get the coverage I want and save money?

For the most affordable rate, you should apply for life insurance as soon as you can. No matter how old you are, you will never be younger than you are today, and your age can play a significant factor in determining your monthly premium. According to

Investopedia

, “The premium amount increases an average of 8% to 10% for every year of age; it can be as low as 5% annually in your 40’s, and as high as 12% annually if you’re over age 50.” So, taking advantage of a lower rate when you are younger and healthier can pay off in the long run.

What will happen if I miss a premium payment?

When you miss a premium payment, you run the risk of your policy lapsing. The good news is that life insurance policies usually have a grace period. Each state is different, but grace periods are usually between 60 to 90 days.

I have employer-sponsored life insurance, is it enough?

If you are lucky enough to have a job with benefits that include employer-sponsored group life insurance, you're off to a great start. Taking advantage of group term life insurance rates can be a great way to supplement individual life insurance coverage, but an employer group policy is usually not enough by itself. Learn why it’s important to have a personal life insurance policy – and how to secure an affordable plan in a few simple steps.

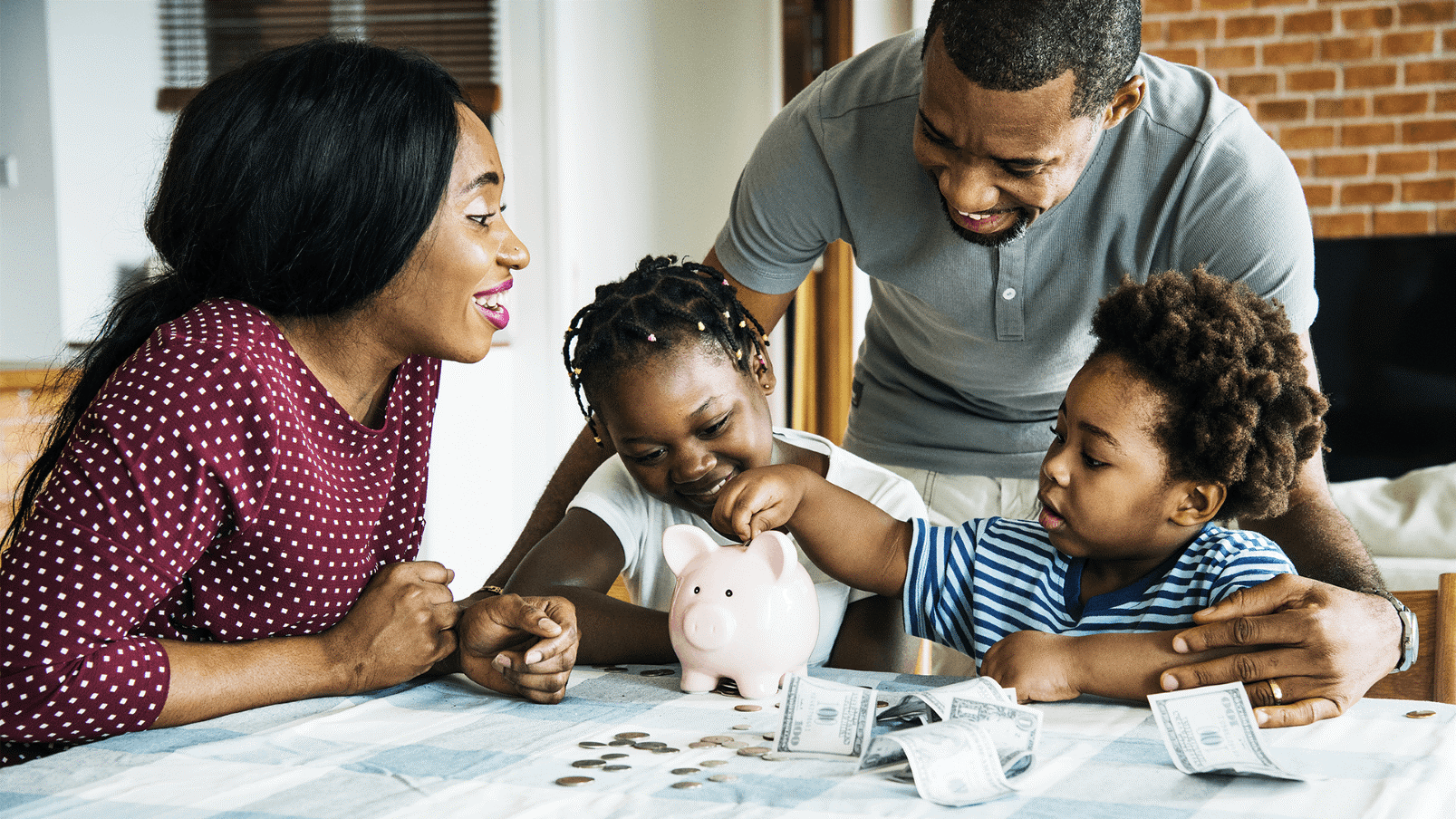

I want life insurance to protect my family, what coverage should I consider?

The main reason most people buy life insurance is to protect their loved ones from financial burden after an unexpected death. Therefore, life insurance is something most families need. No matter your age, there is a life insurance policy that fits your budget, lifestyle and financial goals. Your Symmetry agent will be able to help you determine what type of life insurance would provide you with the best coverage, if term life or universal life is a better fit, and if any riders would be applicable to your coverage for extra protection.

Riders provide extra protection

You can customize your life insurance policy with add-ons called riders, which can provide extra financial protection in the event of the unexpected while you’re alive. Living benefit riders are policy add-ons that can provide a payout if you were to face a critical illness diagnosis or a short or long-term disability during the time your policy is in force.

Choosing a beneficiary

When you find the right type of life insurance for your needs, you will

designate a beneficiary

who will receive the death benefit of your policy if you pass away during the coverage period. If you pay your premiums on time and your policy remains in force, you can have peace of mind knowing your loved ones are financially protected. Your beneficiary can use the death benefit to cover your remaining mortgage amount, cover your final expenses, fund a child’s education, pay off debts, or anything else that they choose. It’s important to choose someone you trust to ensure your final wishes are met.

If something happens to me, do my outstanding debts get paid before my beneficiary receives a check?

In most cases, life insurance proceeds are

exempt from creditors

. In some cases, proceeds may not be exempt if your spouse is your beneficiary and you co-signed certain types of loans. Once your beneficiary receives your life insurance death benefit, these funds could be claimed by creditors seeking money they owe (depending on state regulations). Generally, life insurance proceeds will pass exempt from the insured’s creditors, but there are a couple of exceptions.

The bottom line

Understanding your life insurance policy is important, and your Symmetry agent is here to help! Life insurance needs change over the years and meeting with your agent and knowing what life insurance questions to ask will help you ensure that your loved ones are always covered.

Contact your Symmetry Financial Group agent to get coverage today

Your Symmetry Financial Group agent can help you find the most affordable life insurance policy, annuity, or retirement plan that best fits your unique needs and goals.

If you’re interested in protecting your legacy with life insurance, connect with a Symmetry agent by

requesting a quote

today.