With tax season in full force, many of us are in the process of filing a tax return or determining if we will get a refund. According to the IRS, last year's

average tax refund

was more than $2,500. This year, more than 150 million tax returns are expected, with the vast majority before the May 17, 2021 deadline. If you are fortunate to receive a refund this year, we have a few suggestions on how to make the most out of your tax return.

Build a financial safety net to prepare for the unexpected

Unfortunately, none of us know when an unexpected illness or diagnosis could affect our lives. A cancer diagnosis, heart attack or disability could leave you unable to work and earn income. In this event, how would your family pay the bills? If you don’t have a plan in place, now is a good time to consider

critical illness insurance

.

Critical illness insurance is a policy that will pay a benefit in a lump sum if you are diagnosed with a critical illness that’s covered by the policy. Having this insurance can relieve your family from the emotional and financial stress that comes with any illness.

Get a jump-start on retirement planning

According to a

2020 study

by the Federal Reserve, one-fourth of non-retirees indicated that they have no retirement savings, and fewer than 4 in 10 non-retirees felt that their retirement savings are on track. One of the best ways to prepare for retirement is to choose a life insurance product that offers safety and guarantees, such as an annuity or indexed universal life (IUL) insurance policy.

An

annuity

is an insurance product that allows you to accumulate money over a period of years (by making an initial deposit or periodic deposits). Funds invested in annuities grow tax-deferred. Once you annuitize the contract and turn it into an income stream, you will receive a series of regular payments during your retirement.

Similarly, an

IUL

is a permanent life insurance product that offers life insurance and a cash value savings component. The cash value can be indexed to financial market index so you can accumulate cash inside of your life insurance to use for retirement (or whatever you choose). If you start saving early on, you can enjoy knowing that you will have readily available cash during your retirement years.

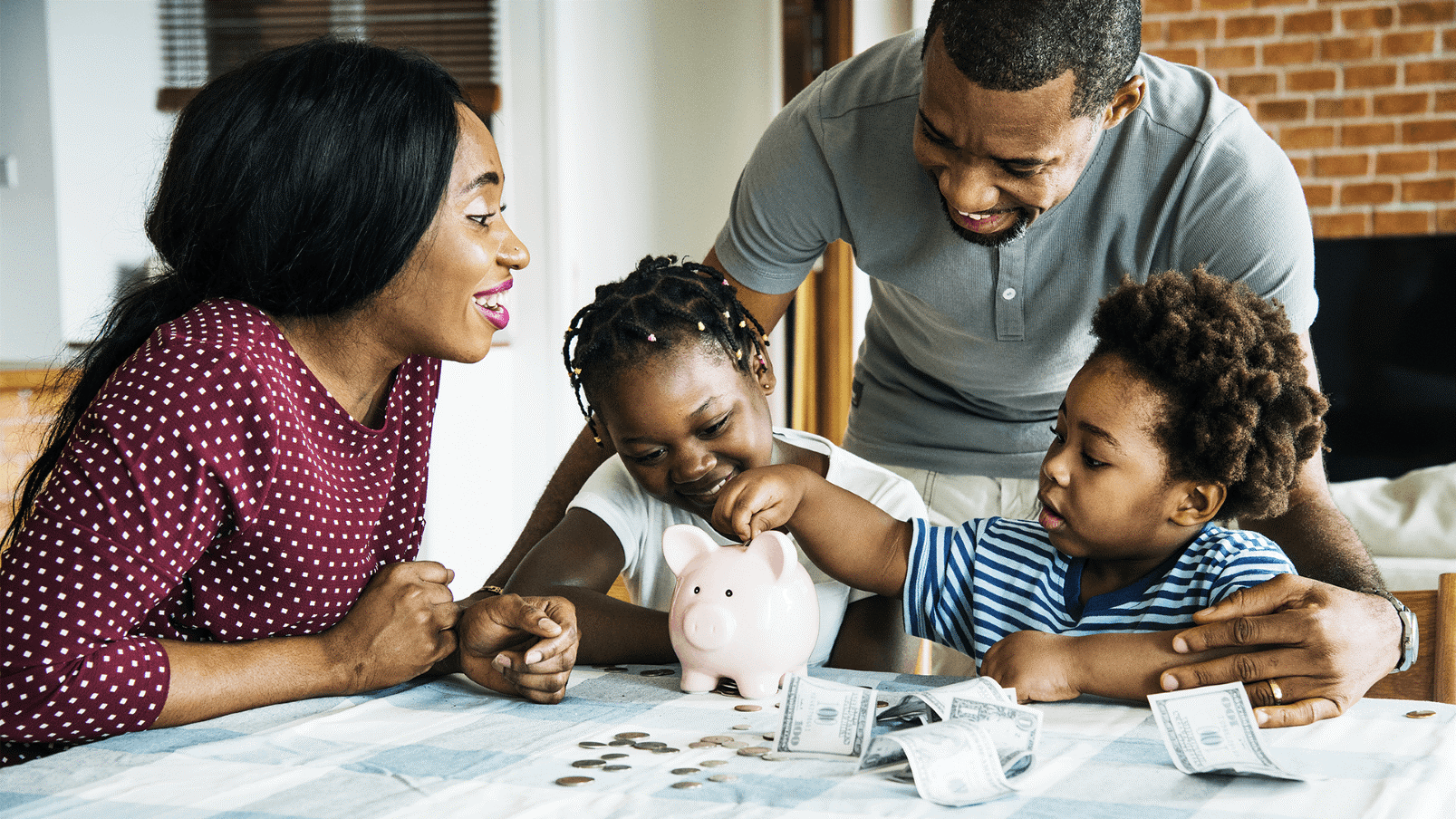

Invest in your child’s future

If you have young children, your first instinct might be to use your tax return to plan a fun vacation. However, before you book the flight, consider investing in your child’s future with a life insurance plan that can help fund their college education. We’re not saying you can’t do both – for as little as a few dollars a day, you can invest in your child’s future and, if you plan wisely, still have enough money to save for that dream vacation.

SmartStart

is a life insurance plan that gives your child a head start on saving for their future while providing the protection of life insurance. The SmartStart plan provides life insurance coverage and a cash value savings component, which your child can access later in life. They can use this money to fund their college education, which is invaluable these days, as rising tuition costs often leave many students saddled with debt. A portion of your premium payment goes toward life insurance coverage, and the balance becomes part of the policy’s cash value (which accumulates tax-free).

We’re here to help

If all this planning sounds overwhelming, we’re happy to help! Our team of licensed insurance agents can help you get the best life insurance coverage for you and your family’s needs.

With exclusive access to policies from over 30 of the top carriers, your Symmetry agent can shop around to find the lowest rates, and they will present plan options that match your budget to make the process easy.

Put your tax return to good use with life insurance coverage fit for your needs -

request a quote

today.

This article is written for informational purposes only and should not be taken as financial advice. For more detailed advice, please reach out to your Symmetry Financial Group licensed insurance agent. This article was updated on March 26, 2021.