Married people often buy life insurance to provide financial protection for their spouses, so if the unthinkable happened, their spouses would have the resources they needed to continue their current standard of living. However, what about single parents? Without a surviving spouse, does a single parent need life insurance? In most cases, the answer to that question is an emphatic “yes.”

Coverage for Expenses: Past, Present and Future

Even as a single parent, you have most of the same insurance needs as anyone else. For example, people frequently purchase

life insurance

to provide a ready source of funds to pay off their mortgages and other debts when they die. Life insurance can also provide money to pay your final expenses, including the cost of a funeral or memorial service and the cost of cremation or a traditional burial.

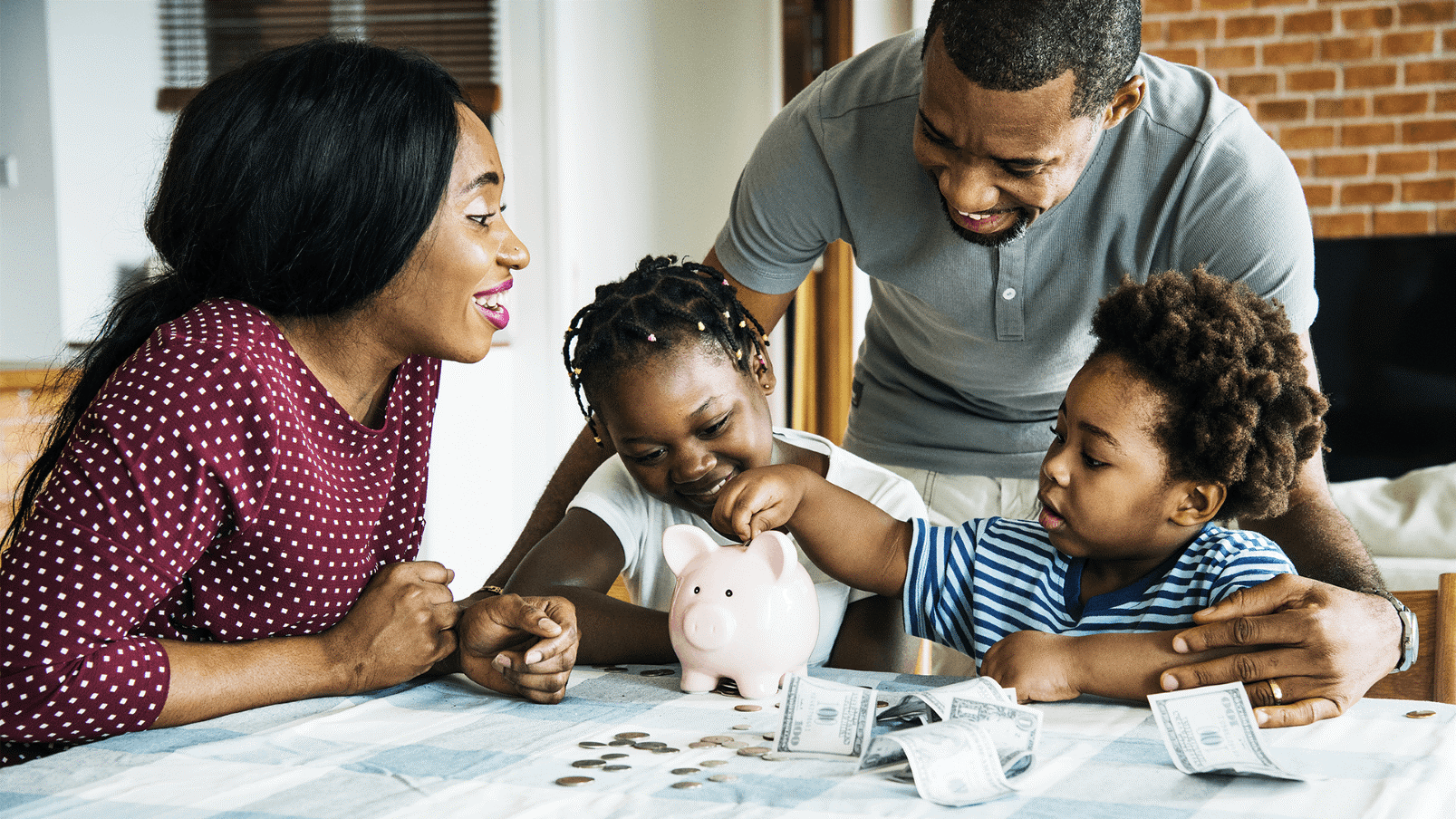

Single parents also need to consider the cost of caring for their children after they’re gone. This includes paying for daycare for young children, food, transportation, lodging, clothing, activities, lessons, sports and other extracurricular activities, entertainment, medical and dental insurance and other expenses. The cost of attending college should also be considered if that’s something that you feel is important for your child’s future.

If you died prematurely, would your child’s caregiver be able to provide them with the care you want them to receive? Life insurance can provide funds for these and any other expenses related to raising your children.

Different Types of Coverage Can Meet Different Needs

When you buy life insurance, your insurance agent can help you determine whether it makes sense to buy term insurance, universal life insurance, final expense coverage or a combination of different policies.

Term Life Insurance

Term insurance

is protection designed to last for a specific number of years. For example, you might buy a 10-year term policy or a 15-year term policy if your primary purpose is to provide financial support for your children’s caregivers in case you pass away while one or more of your children is still a minor. You pay a fixed amount of policy premiums to keep your insurance coverage in force. If you die during the policy term, the insurance company pays a pre-determined death benefit amount to the person you named as the policy beneficiary. If you outlive the policy term, the coverage ends, and you won’t have life insurance anymore unless you choose to either buy a new policy or convert the previous term policy to permanent insurance.

Universal Life Insurance

Universal life coverage provides a fixed policy death benefit but also includes a cash value component inside the policy. The cash value earns interest and you can draw on those funds if needed by taking a policy loan or withdrawal.

Universal life insurance

will stay in force, paying the policy benefits to your named beneficiary, if you keep the policy in force by paying the premiums when due.

Term insurance is typically less expensive than universal life coverage, however, remember that you are essentially renting insurance coverage when you buy a term policy. With universal life insurance, you pay more in premiums but you’re buying a policy designed to last for the rest of your life. For some single parents, the best approach is to buy both a term policy and a universal life policy to provide enough coverage to meet your children’s needs to get them through school and into adulthood, but also to provide you with ongoing, long-term insurance protection even after your children are out of the house.

Consider Your Policy Beneficiary Carefully

When you purchase an insurance policy, you will be asked who should be named as the beneficiary. This is the person who will receive the policy proceeds if you die while the insurance policy is in force.

Sometimes, single parents want to name their designated caregiver/guardian as the beneficiary, thinking that this is the best solution to make sure the caregiver has the funds they need to care for their children. However, keep in mind that your designated guardian or caregiver would be under no legal obligation to use the life insurance proceeds to pay for your child’s care.

It’s usually not a good idea to name a minor child as a policy beneficiary. Minors cannot legally hold and control life insurance policy proceeds on their own. Naming a minor child could mean that someone must go to court to get appointed as the child’s conservator. Then, when your child turns 18, he or she would have complete control over remaining policy proceeds.

It may make sense to talk to an estate planning attorney about establishing either a living trust or a testamentary trust (a trust created in your will). You could designate who would oversee managing money for your children, how that money would be used and at what age (or ages) your children should be able to inherit the proceeds if you die prematurely.

Instead of naming your designated guardian, your minor child or another person as the policy beneficiary for your life insurance, you would name the trust as the policy beneficiary. If you died, the insurance company would pay the policy proceeds to the trust and your designated trustee would be legally bound to use the funds for your children's benefit as stipulated in the trust agreement.

Symmetry Financial Group Can Help Evaluate Your Insurance Needs and Offer Solutions

If you are a single parent and died prematurely, would your child and his or her guardian have the financial resources you would want them to have in your absence? To learn more about how life insurance can protect your dreams for your child’s future, and to purchase coverage designed to meet your needs and your budget,

contact

your Symmetry Financial Group Independent Insurance Agent today.