For a slight increase in your premium, family insurance riders provide additional coverage to you and your loved ones if a spouse or child passes away while you are still alive. In this article, the second in our series on

life insurance riders

, we are taking a closer look at family riders (which are also referred to as Additional Insured riders).

Spousal rider

If you have a

life insurance

policy, you can add a spousal rider, which will provide financial protection in the event your spouse dies before you.

This rider can be applied to many different types of life insurance policies. In some states, this rider can also cover registered domestic partners or civil union partners. This rider is often used to help with burial costs if the insured spouse were to pass away while the policy is active. Keep in mind that if you get divorced, the rider won’t cover the spouse and they will be left without coverage.

The spousal rider expires at the same time your policy ends or when your spouse reaches a certain age. If your policy is ending and your spouse still needs life insurance, some carriers offer the option of converting this rider to a whole life policy under certain time frames and age limits.

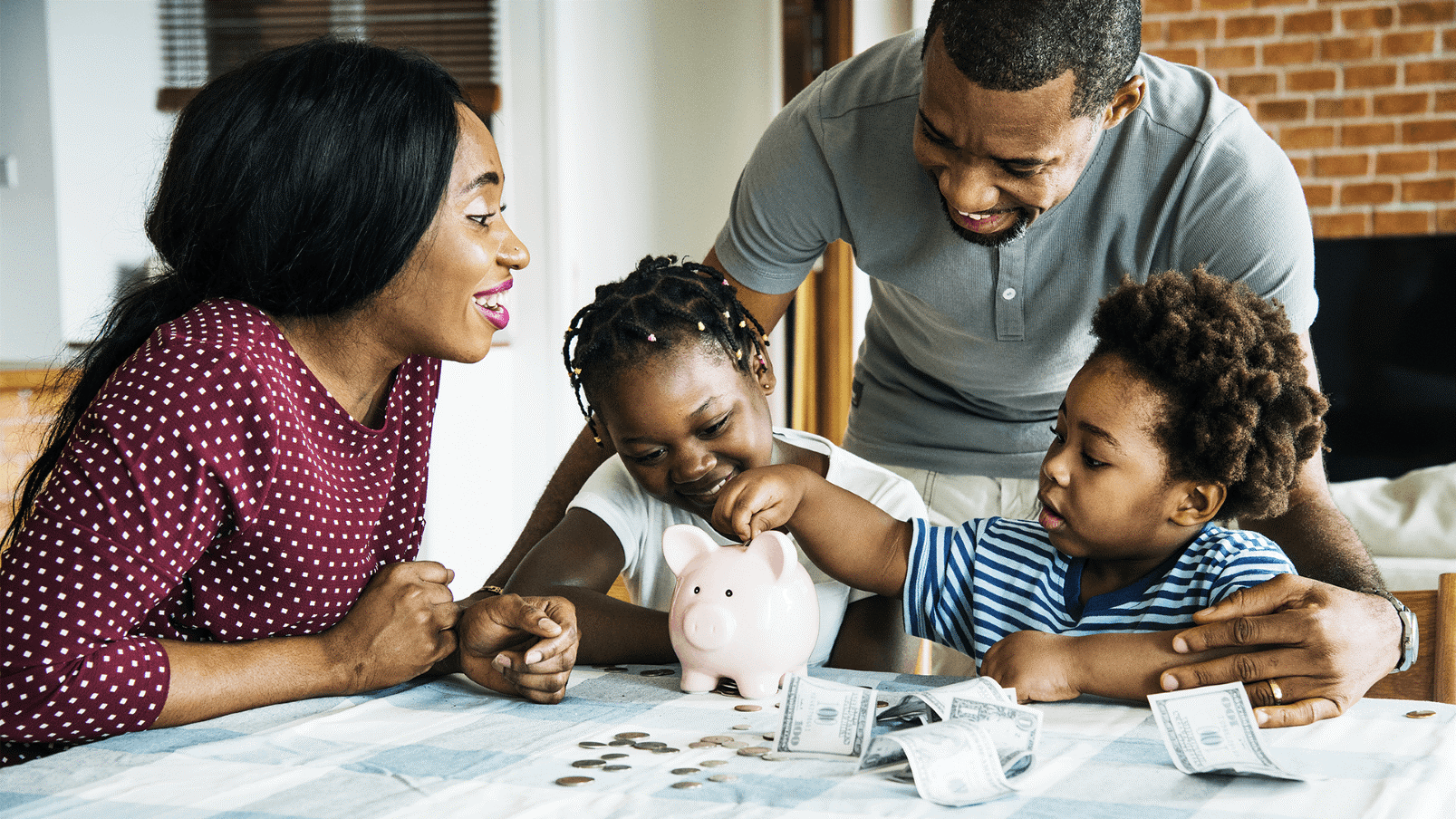

Child rider

A child rider provides a death benefit in the event your child passes away. Should the worst happen, the payout from this rider can cover costs associated with a funeral and memorial service.

This rider usually covers all current and future children in your household, including adopted children and stepchildren, and coverage usually lasts until the child turns 25 years old. In most cases, you’ll need to add this rider when you’re applying for coverage, but some carriers will let you add the child rider within a certain (short) time frame after your policy is already in force. This rider is generally an affordable option and can provide anywhere from $50,000 to $100,000 worth of coverage.

On the other hand, if your child is alive at the end of the policy term, this rider can lock in their future insurability. When your children reach adulthood, they may have the option to convert the child rider into a permanent life insurance policy. This can be a great option for kids who have medical issues that make it difficult or impossible for them to qualify for a more affordable term life policy.

If you are looking for a long-term investment for your child, you should consider the

SmartStart program

, which offers a life insurance coverage with a cash value savings component inside the policy. With SmartStart, your child can get a head start on saving for their college education, the down payment on a home, and even their retirement, and the policy doesn’t expire exactly when yours does, as this is an independent life insurance product and not a rider.

Add coverage for your spouse or children to your life insurance policy

If you want to add an extra layer of financial protection to your life insurance policy, a family rider for your spouse or child is a perfect fit.

Are you interested in learning more about getting life insurance? We are here to help! All you need to do is

request a quote for life insurance

. From there, you will get connected with a Symmetry Financial Group Agent who can help you choose the best life insurance and family riders for your needs.